MuskegonPundit

Important stuff you won't get from the liberal media! We do the surfing so you can be informed AND have a life!

Tuesday, January 06, 2026

History for January 6

History for January 6 - On-This-Day.com

Loretta Young 1913

- 1838 - Samuel Morse publicly demonstrated the telegraph for the first time.

- 1942 - The first commercial around-the-world airline flight took place. Pan American Airlines was the company that made history with the feat.

- 1945 - The Battle of the Bulge ended with 130,000 German and 77,000 Allied casualties.

- 1952 - "Peanuts" debuted in Sunday papers across the United States.

- 1994 - Figure skater Nancy Kerrigan was clubbed on the right leg by an assailant at Cobo Arena in Detroit, MI. Four men were later sentenced to prison for the attack, including Tonya Harding's ex-husband.

Monday, January 05, 2026

Nobel-Winning Venezuelan Opposition Leader Humiliates Democrats: 'The Hour of Freedom Has Arrived'

Nobel-Winning Venezuelan Opposition Leader Humiliates Democrats: 'The Hour of Freedom Has Arrived':

Democrats in the U.S. pretend to be the defenders of democracy, but if it means opposing Trump, they’re more than willing to tacitly defend the regime of a despot like Maduro. The now-former Venezuelan leader maintained power by making a mockery of elections, like the 2024 contest he claimed to win even as exit polls showed the opposition taking 70 percent of the vote, as USA Today reported.

Machado’s trumpeting of “popular sovereignty” was a call for actual democracy — one now possible in Venezuela thanks to Trump’s action.

In 2025 alone, the state of Oregon filed 52 lawsuits against the Trump administration — costing taxpayers $3.1 MILLION.

This wasn’t about protecting Oregonians — it was about political resistance theater, paid for by YOU. - The Hodgetwins $855,000 fighting the deployment of National Guard troops to stop chaos in Portland

$855,000 fighting the deployment of National Guard troops to stop chaos in Portland

$500,000 challenging tariffs

$500,000 challenging tariffs

$115,000 suing over a temporary federal funding freeze

$115,000 suing over a temporary federal funding freeze

And millions more just to keep the legal war going

And millions more just to keep the legal war going

Imagine what $3.1 million could’ve done for:

• Police staffing

• Mental health services

• Roads and infrastructure

• Wildfire prevention

But no — endless lawsuits were the priority.

- Here’s the breakdown

$855,000 fighting the deployment of National Guard troops to stop chaos in Portland

$855,000 fighting the deployment of National Guard troops to stop chaos in Portland $500,000 challenging tariffs

$500,000 challenging tariffs $115,000 suing over a temporary federal funding freeze

$115,000 suing over a temporary federal funding freeze And millions more just to keep the legal war going

And millions more just to keep the legal war going

- Instead of fixing homelessness, public safety, drug addiction, or schools, Oregon’s leadership chose lawfare over governance.

Imagine what $3.1 million could’ve done for:

• Police staffing

• Mental health services

• Roads and infrastructure

• Wildfire prevention

But no — endless lawsuits were the priority.

18-year-old ISIS sympathizer who allegedly planned New Year's Eve terror attack in North Carolina is arrested | Blaze Media

18-year-old ISIS sympathizer who allegedly planned New Year's Eve terror attack in North Carolina is arrested | Blaze Media:

A North Carolina man who allegedly planned to use knives and hammers for a New Year's Eve attack at a grocery store and a fast food restaurant in support of ISIS was arrested and charged with attempting to provide material support to a foreign terrorist organization, federal officials said Friday.

Marco Rubio schools Margaret Brennan after she demands answers over why the U.S. did not arrest all of Nicolas Maduro's henchmen:

"You're confused? I don't know why that's confusing to you. ... - Ryan Saavedra@RyanSaavedra

- It is not easy to land helicopters in the middle of the largest military base in the country, the guy lived on a military base, land within three minutes, kick down his door, grab him, put him in handcuffs, read him his rights, put him in a helicopter and leave the country without losing any American or any American assets.

- That's not an easy mission.

And you're asking me, why didn't we do that in five other places at the same time?

- I mean, that's absurd."

WATCH: Major network anchor admits media has put too much credence in academics & elites * WorldNetDaily * by Nicole Silverio, Daily Caller News Foundation

WATCH: Major network anchor admits media has put too much credence in academics & elites * WorldNetDaily * by Nicole Silverio, Daily Caller News Foundation:

CBS News anchor Tony Dokoupil admitted on Thursday that legacy media has ignored the perspective of average Americans and put "too much weight" into the views of the elites.

The media would rather have abject failure, international humiliation, $billions of weapons in terrorist hands, and a population predestined for disaster -- but with pronouns and men dressed as women ...

Instead of one of the most stunning and precise military actions in history - Sev Onyshkevych

...combining multiple branches of the military, the DEA, the CIA, the DOJ and more, with ZERO US casualties, ZERO equipment damage, ZERO collateral damage, a nation thankful for salvation and every bad actor in the world chastened, including Russia's vaunted BUK air defense, $billions of China's shiny new baubles and the elite Cuban guard.

...combining multiple branches of the military, the DEA, the CIA, the DOJ and more, with ZERO US casualties, ZERO equipment damage, ZERO collateral damage, a nation thankful for salvation and every bad actor in the world chastened, including Russia's vaunted BUK air defense, $billions of China's shiny new baubles and the elite Cuban guard.

- Clearly, the enemedia is one of the worst actors, and you cannot possibly hate them enough.

If you are American and you’re curious about why Trump forced Maduro out, you should read this first...

Because unless you are Venezuelan, you are missing almost everything that matters. - Juan Pablo Sans(An analysis by a Venezuelan who left Venezuela)

I am Venezuelan.

I left my country in 2013, when Hugo Chávez died and Nicolás Maduro took power.

I didn’t leave because I wanted to “try life abroad.”

I left because I could see what was coming, and staying meant watching my future shrink year after year.

I am Venezuelan.

I left my country in 2013, when Hugo Chávez died and Nicolás Maduro took power.

I didn’t leave because I wanted to “try life abroad.”

I left because I could see what was coming, and staying meant watching my future shrink year after year.

- So when Americans ask, “What do Venezuelans think about Trump forcing Maduro out of the presidency?”

- Most Venezuelans feel relief...Read all!

Trump teases Mexican drug cartels as next potential target for military intervention * WorldNetDaily * by Harold Hutchison, Daily Caller News Foundation

Trump teases Mexican drug cartels as next potential target for military intervention * WorldNetDaily * by Harold Hutchison, Daily Caller News Foundation:

President Donald Trump hinted Saturday morning that Mexican drug cartels could be the next target of American military action during a phone interview on Fox News.

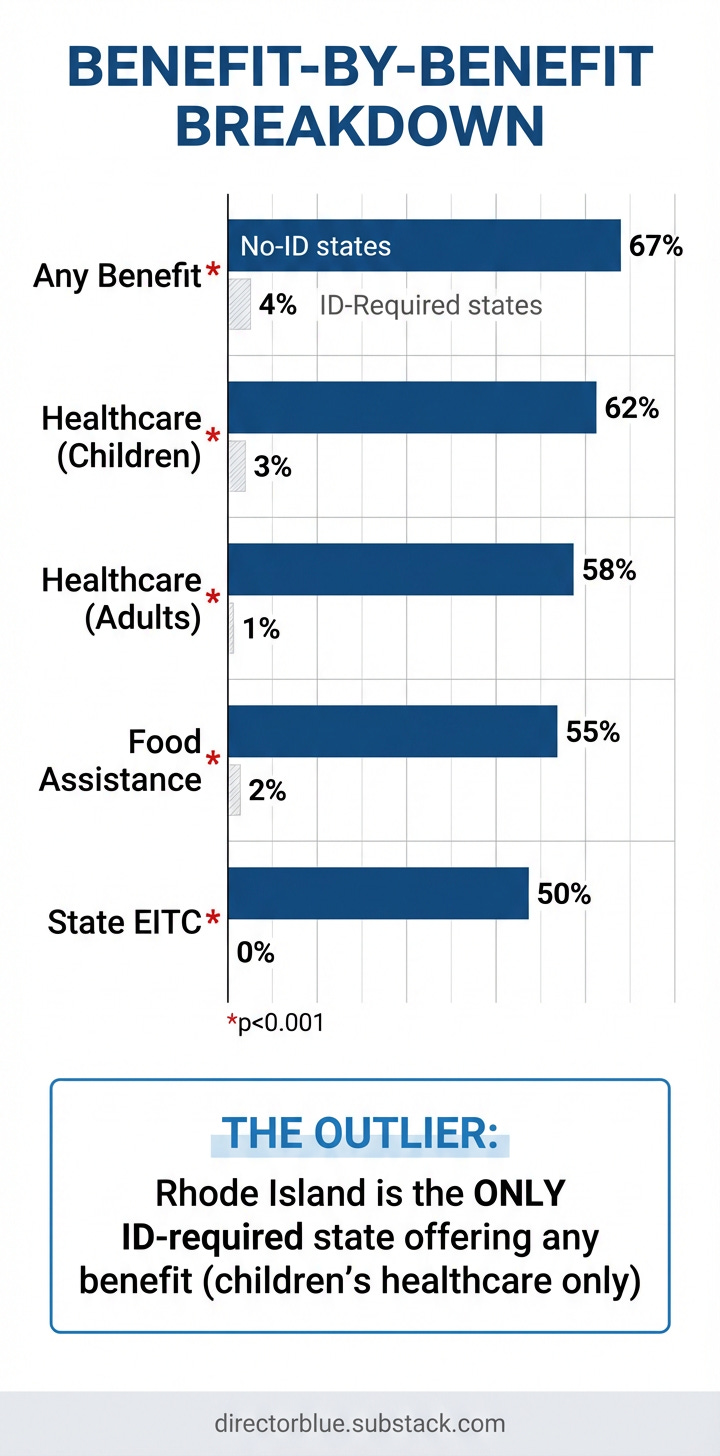

Infographic: States with No Voter ID Pay 16 Times More Welfare for Illegals

The stunning analysis by Kevin Bass - Doug Ross - Based upon the viral thread by Kevin Bass.

- Summary: Democrats are importing welfare-dependent illegals to secure a voting majority.

That’s why they hate the concept of Making America Great.

- They want to remake America where they control power forever.

History for January 5

History for January 5 - On-This-Day.com

Stephen Decatur 1779

- 1781 - Richmond, VA, was burned by a British naval expedition led by Benedict Arnold.

- 1896 - It was reported by The Austrian newspaper that Wilhelm Roentgen had discovered the type of radiation that became known as X-rays.

- 1914 - Ford Motor Company announced that there would be a new daily minimum wage of $5 and an eight-hour workday.

- 1961 - "Mr. Ed" debuted. The show would run for six years.

- 1972 - U.S. President Richard M. Nixon ordered the development of the space shuttle.

- 1998 - U.S. Representative Sonny Bono died in skiing accident.

Subscribe to:

Comments (Atom)