"With the federal budget, too, the problem is spending growth – specifically, entitlement spending growth.

Entitlement programs are those in which ongoing spending is automatically authorized by law, without lawmakers needing to appropriate funds each year...

One need not look for long at the contours of federal budget operations to see this.

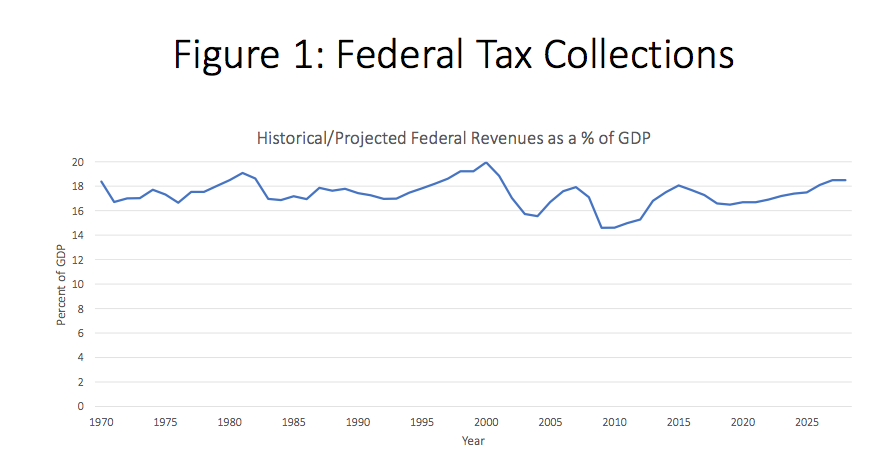

Consider tax collection patterns first.

Figure 1 shows that nothing historically aberrant is happening on the tax side to bring about our huge deficits.

Entitlement programs are those in which ongoing spending is automatically authorized by law, without lawmakers needing to appropriate funds each year...

One need not look for long at the contours of federal budget operations to see this.

Consider tax collection patterns first.

Figure 1 shows that nothing historically aberrant is happening on the tax side to bring about our huge deficits.

As Figure 1 shows, federal tax policy has been largely consistent throughout modern history--collecting between 16 percent and 19 percent of GDP in the vast majority of years.

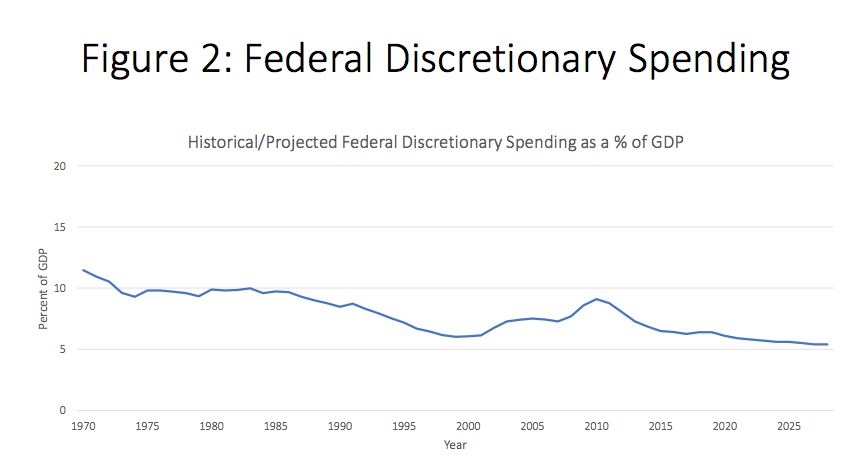

Nor, as figure 2 shows, is appropriated/discretionary spending the problem...

Nor, as figure 2 shows, is appropriated/discretionary spending the problem...

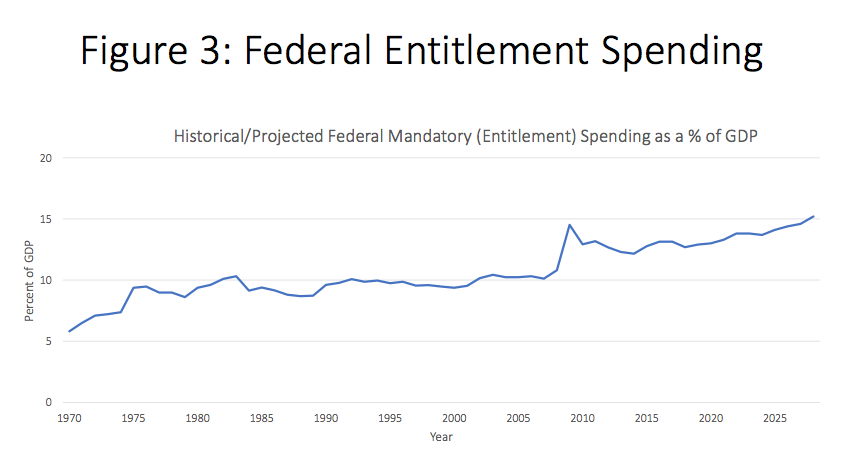

If national tax burdens have remained roughly consistent, and discretionary spending has become relatively more affordable, why have deficits climbed into the stratosphere?

The answer is straightforward and is evident in Figure 3.

Read on!

No comments:

Post a Comment