"It's Spooky": Stanford Professor Warns Thousands Of US Banks Are "Potentially Insolvent" | ZeroHedge - BY TYLER DURDEN

- Following the collapse of First Republic last week, the meltdown of three other banks, and the Federal Reserve's quarter-point increase, making the tenth straight hike in an aggressive campaign to tame elevated inflation, a professor of finance at the Stanford Graduate School of Business presented a grim warning that the regional banking dominos are falling.

- In a New York Times opinion piece titled "Yes, You Should Be Worried About a Potential Bank Crisis. Here's Why," Professor Amit Seru wrote, "the fragility and collapse of several high-profile banks are most likely not an isolated phenomenon." He said, "A damaging combination of fast-rising interest rates, major changes in work patterns, and the potential of a recession could prompt a credit crunch not seen since the 2008 financial crisis."...

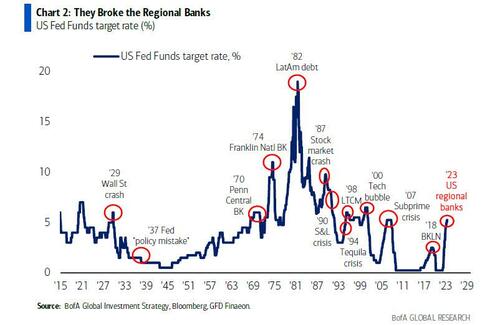

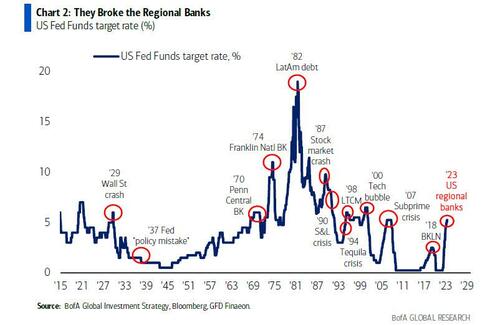

...Our latest note, featuring BofA strategist Michael Hartnett highlights that "

every Fed tightening cycle ends in crisis", in this case US regional banks.

No comments:

Post a Comment