The warnings come from JP Morgan, whose CEO Jamie Dimon warns that inflation will stay higher for longer than markets think, driven by massive federal deficits.

- He warns this higher inflation would also keep interest rates high, which could crash smaller companies who are running out of cash. It would also keep mortgages and credit cards at rates slightly higher than the mafia charges.

- The second warning comes from Citigroup, which put out a new report predicting what Zerohedge calls a “rate-cut bomb”—a near-panicked series of 10 interest-rate cuts starting in a few months and running all the way to next July.

That’s something that only happens when the economy careens into recession, when the Fed desperately pumps rescue meds—that is, rate cuts—to an economy that’s flat-lined.

- Put them together, and Dimon thinks inflation will keep running.

- Citi thinks the economy will collapse.

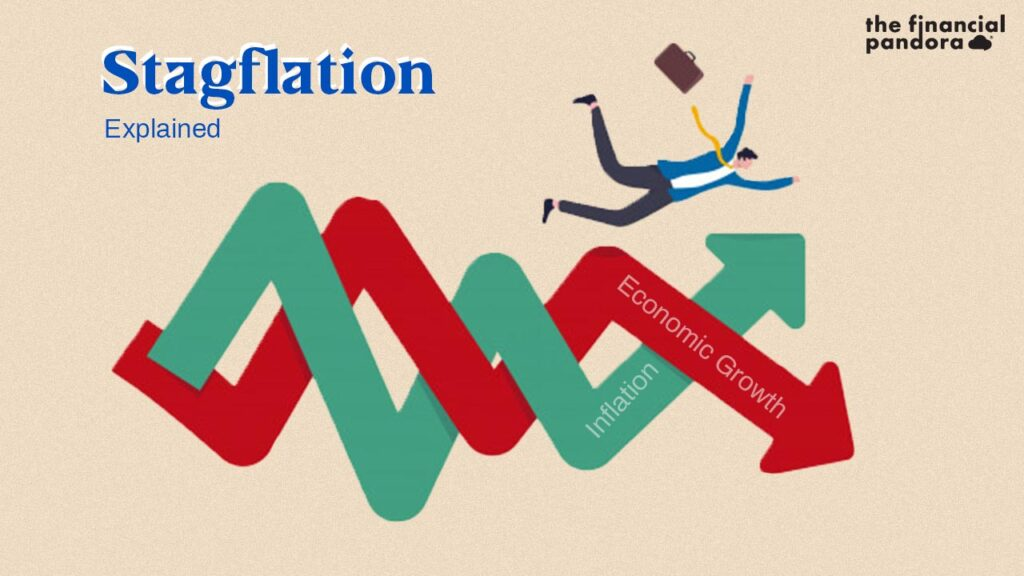

We have a name for that—stagflation.

No comments:

Post a Comment